#370 “Barbell” Product Strategy

Friday Ship #370 | October 20th, 2023

This week, after refreshing our company strategy product squads decided where to invest their efforts next.

Every 4 months, our company refreshes its strategy in an open and inclusive process. Just before adopting a new strategy it’s often the case the company feels like it’s at its most unaligned. Individuals have differing opinions on what to invest in next. Refreshing our strategy puts everybody back in touch with what’s important. Completing the strategy development process feels like a fresh start.

Our company strategy tries to fall short of dictating a particular solution and instead frames which opportunities or challenges should be pursued. Sometimes an element of our strategy points the company at focusing on a single metric (virality, conversion, usage expansion, etc.) This leaves developing solutions up to the team.

As CEO, one of the roles I have is coaching and discussing where we should invest our resources. One of the challenging aspects of running a product company is there is no single “best practice” for product management. The ways companies invest their resources and go about their work is extremely varied between and within companies. Over the years of operating this company and working for others, I’ve noticed one of the things that tends to differ greatly is appetite for risk: do we only bring to market what people ask for? Or, do we trust our intuition and bring something into the world it can’t imagine?

I believe all companies need to be good at investing in two areas: areas of low risk and high risk at the same time.

Investing along a barbell-shaped product portfolio

Several of the conversations I’ve had this week centered on reminding folks to invest efforts along a barbell. Wait. Don’t stop reading. I know that sounds like braided-leather belt, cigar-chomping steakhouse b-school jargon. It’s worthwhile. Let me explain it.

Product Quality researcher Noriaki Kano theorized that the key to delighting customers was to invest one’s efforts into minimizing dissatisfaction by meeting basic needs while maximizing the possibility of delighting customers by providing unexpected benefits. Central to Kano’s view of product management is to avoid the middle ground, that is to say, to generally avoid investing in things customers say they want and instead invest in features they must have and features they never ask for but would be delightful if they existed. What on earth, you might ask, does this have to do with barbells?

The concept of a “barbell strategy” in investment was written by Nassim Nicholas Taleb. He is a Lebanese-American scholar, statistical analyst, former trader, and risk analyst, who has focused much of his work on problems of randomness, probability, and uncertainty and author of the book The Black Swan: The Impact of the Highly Improbable. The essence of the his “barbell strategy” is to invest the majority of assets in extremely safe investments, like Treasury bills or other government bonds, and a small portion in high-risk, high-reward investments. The idea is that the safe investments protect the bulk of your wealth, while the high-risk portion has a potentially unlimited upside. This approach avoids the “middle” risk investments, which Taleb argues have a riskier profile than perceived and do not provide significant gains in many scenarios, especially during unforeseen “Black Swan” events — rare and unpredictable occurrences that have severe consequences.

Why is this a barbell? Imagine a single axis: left on the axis is extremely low risk, right on the axis is extremely high risk. If you stack bets on either end of this axis you’d get two lumps on other end: a figure that is roughly barbell-shaped.

Basic Needs and Safety

In the barbell strategy, the “safe” investments are akin to the basic needs in the Kano model. Just as customers expect basic features and their absence causes dissatisfaction, investors expect to have a significant portion of their portfolio in “safe” investments to prevent dissatisfaction (or financial loss).

Excitement Needs and Risk

The risky end of the barbell strategy can be compared to the Kano model’s “excitement needs”. Just like excitement features in a product surprise and delight customers, the risky investments have the potential for high returns. However, just as the absence of excitement features doesn’t cause dissatisfaction, the poor performance of high-risk investments is often expected and doesn’t necessarily dissatisfy an investor who follows a barbell strategy, because the bulk of their assets are safe.

Avoiding Mediocrity

The message I’ve re-enforced with my colleagues this week is we must be careful not to only invest in what’s safe—for we might ever only see modest returns. We must be careful to not only invest in what’s extremely risky and speculative as we may never see any return. We must do both at the same time. And, we must also be careful to avoid developing features that users say they merely want (rather than absolutely need) – as fulfilling wants neither prevents dissatisfaction from ignoring needs nor grants the same magnitude of delight by causing excitement.

We must invest in a barbell – fulfilling needs and creating excitement.

Metrics

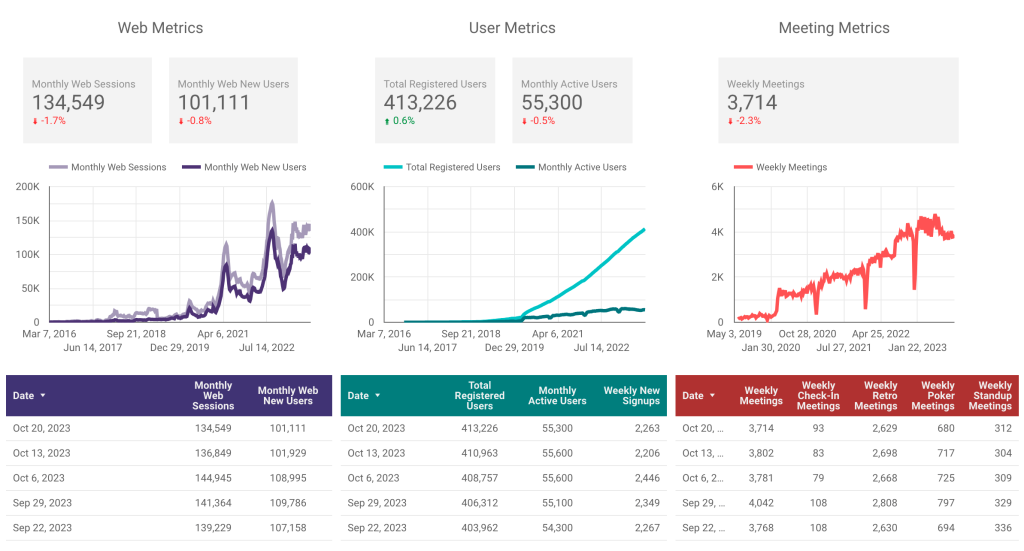

Metrics were slightly lower over last week — while we’ve mostly seen bullish growth numbers since the end of summer holidays, it’s not unheard of for us to have the occasional slow week that may be tied to trends when agile teams tend to observe their rituals.

This week we…

…performed a major infrastructure migration. Ok, so technically this hasn’t happened yet. It’s scheduled for Saturday, October 21st. We’re migrating from orchestrating container images using dokku to Google’s GKE Kubernetes platform. Doing so will give us a number of advantages in being able to scale our infrastructure, while also maintaining and evolving our public SaaS to use the same Kubernetes architecture as we provide for our private-hosted and self-hosted customers. We’ll have more to write about this in a future Friday Ship.

…rolled out Kubernetes to our development team.

…submitted a number of SBIR proposals. Our PubSec team has been positively jamming speaking to stakeholders within the U.S. Department of Defense and authoring proposals for funding to expand Parabol’s footprint within the U.S. Government.

…product squads reprioritized to match this trimester’s strategy.

Next week we will…

…observe how our SaaS performs on our new Kubernetes infrastructure.